Alec Electric Vehicle Taxes - Electric Car Tax Credit Everything that You have to know! Get, How much tax, vat and fees for buying a new electric vehicle in norway is 2023. There’s also usually a vehicle tax of some sort, although not always an incentivized reduction for evs. Electric Vehicle Tax Credit Explained 1800Accountant, The tax is to be paid by a licensed electric fuel dealer. The electric vehicle road user tax is intended to ‘cover the cost of revenue lost from the fall in fuel excise duty raised from the sale of petrol and diesel’.

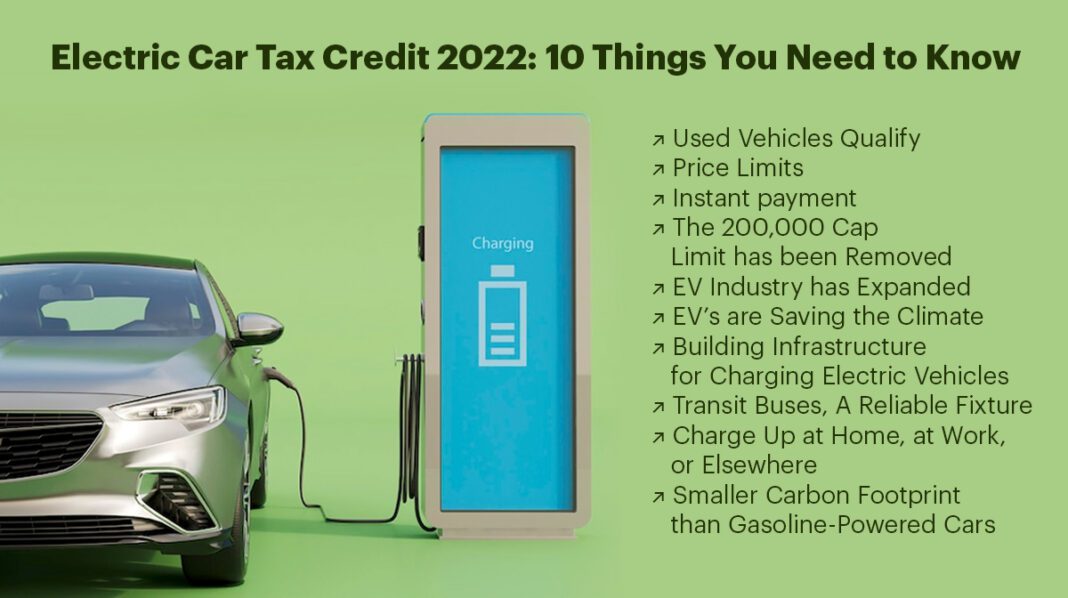

Electric Car Tax Credit Everything that You have to know! Get, How much tax, vat and fees for buying a new electric vehicle in norway is 2023. There’s also usually a vehicle tax of some sort, although not always an incentivized reduction for evs.

How Do Electric Car Tax Credits Work? YouTube, For some state lawmakers, evs have gained a reputation as $100,000 cars with owners who can afford to pay the fees, says. The guidelines aim to promote the development of electric vehicle (ev) charging and battery swapping infrastructure in kenya.

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, The credit is also available if you buy a previously owned electric or fuel cell vehicle for up to $25,000. But in most cases, the tax on domestic power usage is at.

The internal revenue service (irs) defines the clean vehicle tax credit for used vehicles as a credit that equals 30% of the sale price up to a maximum credit of.

Alec Electric Vehicle Taxes. However, for used vehicles, the tax credit equals 30% of the. People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks.

Essentially the less emissions that your car produces, better the impact. Visit fueleconomy.gov for a list of qualified vehicles.

Electric Vehicle Tax Credit What Qualifies & How to Save Money KB, The internal revenue service (irs) defines the clean vehicle tax credit for used vehicles as a credit that equals 30% of the sale price up to a maximum credit of. Electric vehicle buyers can get up to $7,500 in tax savings right at the dealership, under changes to the law that went into effect jan.

The credit is also available if you buy a previously owned electric or fuel cell vehicle for up to $25,000.

What You Need To Know About Electric Vehicle Tax Credits Elmer's Auto, Currently, no electric vehicle on the market will qualify for the full tax credit when battery requirements take effect in 2023, according to the alliance for automotive innovation. The internal revenue service (irs) defines the clean vehicle tax credit for used vehicles as a credit that equals 30% of the sale price up to a maximum credit of.

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

Electric Vehicle Tax Credit Guide 2023 Update), People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks. The guidelines aim to promote the development of electric vehicle (ev) charging and battery swapping infrastructure in kenya.

Electric Car Tax Credit 2025 10 Things You Need to Know EVehicleinfo, The internal revenue service (irs) defines the clean vehicle tax credit for used vehicles as a credit that equals 30% of the sale price up to a maximum credit of. The credit is also available if you buy a previously owned electric or fuel cell vehicle for up to $25,000.